Aligning Sourcing Strategies Across Peru, Colombia, and Honduras

- ElevaFinca

- 2 days ago

- 4 min read

2026 Harvest Calendar Overview

As we look ahead to the 2026 season, we are pleased to share a consolidated overview of harvest timelines, processing windows, and export availability across our key origins. This calendar is designed to help green coffee buyers plan sourcing strategies with greater clarity, align logistics more efficiently, and access coffees at their optimal moment of freshness and quality.

Below, we summarize the key harvest dynamics by origin, followed by practical recommendations for buyers planning contracts and shipments in 2026.

Peru: 2026 Harvest and Export Outlook

The 2026 coffee harvest in Peru is expected to take place between April and October, with timing variations driven primarily by altitude.

Harvest calendar by altitude

Low altitude zones: April to July, with peak harvest between May and June

Mid altitude zones: April to August, with peak harvest between July and August

High altitude zones: May to October, with peak harvest between August and September

These staggered cycles reflect differences in climate, elevation, and maturation pace. Current rainfall patterns remain within expected ranges and, if maintained, could slightly accelerate ripening, resulting in a marginally earlier harvest under favorable conditions.

Processing and export timing

Following harvest, coffee moves through wet processing, drying, and storage. Milling and dispatch are not tied to a rigid calendar, as producers may choose to sell immediately or stagger sales based on market conditions.

The main export window for Peruvian coffees is expected to extend from late April through October 2026. Commercial samples are anticipated from the second half of April, allowing buyers to evaluate fresh crop coffees early in the season.

Specialty and microlot availability

Microlots and differentiated profiles are concentrated in high altitude zones. Peak availability is expected between August and September, aligning with the high zone harvest peak.

Logistical considerations

Between October and November, shipping lines often prioritize refrigerated cargo, which can limit dry container availability and lead to schedule adjustments. Advance planning during this period is strongly recommended.

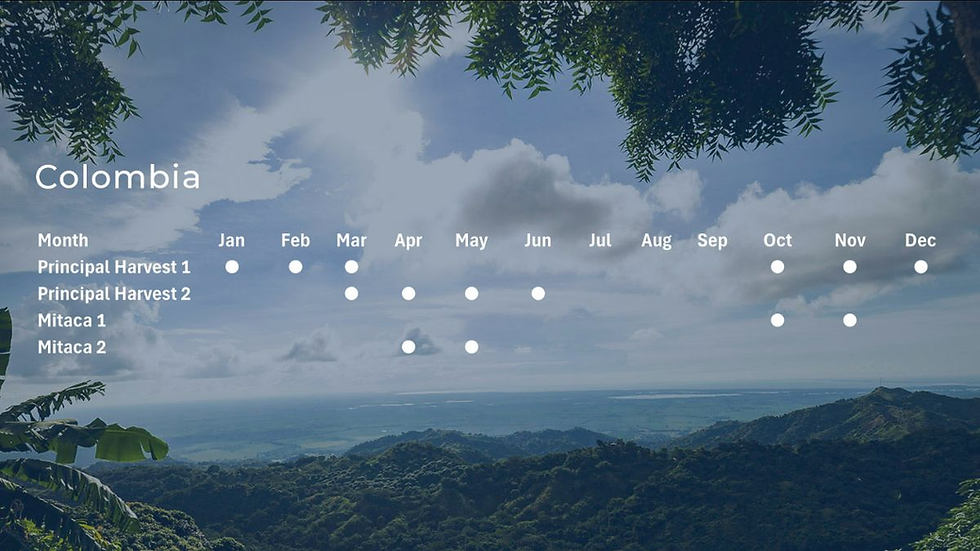

Principal Harvest 1: Sierra Nevada de Santa Marta (Magdalena, Cesar, Guajira), Santander, Norte de Santander, Antioquia (Norte), Huila (Sur), Risaralda, Caldas, Antioquia (sur)

Principal Harvest 2: Norte de Santander, Cundinamarca, Tolima, Huila (Norte), Cauca, Quindío, Valle del Cauca, Nariño

Mitaca 1: Norte de Santander, Cundinamarca, Tolima, Huila (Norte), Cauca, Quindio, Valle del Cauca.

Mitaca 2: Huila (Sur), Risaralda, Caldas, Antioquia (sur)

Colombia: Dual Harvest Cycles and Market Planning

Colombia’s coffee production follows a dual harvest structure that offers year-round flexibility but requires careful planning.

Main harvest cycles

October to March: Sierra Nevada de Santa Marta, Santander, Norte de Santander, Antioquia (North and South), Huila (South), Risaralda, Caldas

March to June: Norte de Santander, Cundinamarca, Tolima, Huila (North), Cauca, Quindío, Valle del Cauca, Nariño

Peak periods typically occur in November and December for the first cycle, and April and May for the second.

Mitaca harvest

October to November: Norte de Santander, Cundinamarca, Tolima, Huila (North), Cauca, Quindío, Valle del Cauca

April to May: Huila (South), Risaralda, Caldas, Antioquia (South)

The mitaca plays a critical role in balancing supply, particularly in years affected by climatic variability. Favorable flowering conditions suggest a solid mitaca contribution in 2026, supporting short- and mid-term supply planning.

Export windows

Export operations are structured around short commercial cycles, typically three to four months from contract to shipment. This approach reflects market volatility and logistics constraints while helping align availability, quality, and pricing within defined windows.

Quality-focused availability

Premium lots, including washed Gesha and experimental fermentations, are most available during the following periods:

November to January: Sierra Nevada, Santander, Huila (South), Antioquia, Risaralda, Caldas

April to May: Cauca, Nariño, Tolima, Huila (North), Valle del Cauca

Buyer recommendations

Effective planning in Colombia requires flexibility. Buyers are encouraged to plan on a semiannual basis, account for potential harvest shifts caused by weather, and align shipping expectations with realistic export windows rather than fixed calendar dates.

Honduras: Altitude-Driven Availability and Export Flow

In Honduras, altitude plays a decisive role in harvest timing and export readiness.

Harvest calendar by altitude

Low zones (700 to 900 meters): October 2025 to February 2026, representing roughly 80 percent of total volume

Mid zones (1,000 to 1,300 meters): November to March, accounting for approximately 46 percent of national production

High zones (above 1,300 meters): December to April, representing approximately 25 percent of production

Because the majority of production occurs in mid and high altitude zones, national harvest activity peaks between December and February, with the highest volumes typically available in January and February.

Processing and export timeline

Milling generally begins in November or December. The main export window runs from the second half of February through the second half of June, once coffees have completed wet processing, drying, and consolidation. Exportable samples are typically available about one month prior to shipment, once lots are finalized and quality parameters are confirmed.

Logistics and container planning

With Puerto Cortés as the country’s only maritime port, congestion is common during peak export periods. Buyers are advised to maintain bookings with at least two shipping lines, align production schedules closely with the dry mill, and allow flexibility for container availability and port congestion.

Key Takeaways for Buyers Planning 2026 Sourcing

Across all origins, successful planning in 2026 will depend on aligning contracts with harvest calendars, altitude specific availability, and realistic export windows. Early engagement allows access to fresher coffees, stronger profiles, and differentiated lots while reducing logistical risk.

We encourage buyers to:

Secure specialty and certified lots early

Maintain flexibility in shipment timing

Coordinate closely on samples, approvals, and documentation

Build long term sourcing relationships that support priority access and continuity

Our team remains available to support origin specific planning, sample coordination, and contract structuring for the 2026 season.

Our latest coffee offer is constantly updated here

Comments